Social Security Reform Finally Advances

The greatest "risk" is not reform: it's doing nothing.

by Rod D. Martin

July 23, 2004

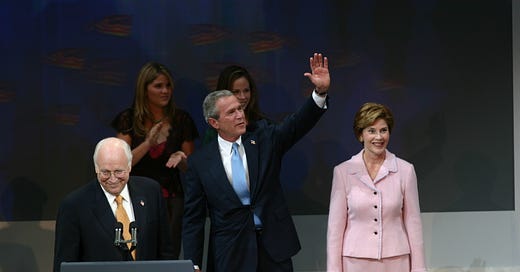

For Beltway leftists, it's one of their worst nightmares. For true-blue conservatives, it's one of their greatest hopes. Forty years ago, Ronald Reagan suggested it; more recently, Daniel P. Moynihan recommended it. And last January, President Bush proposed it -- while Senator John Kerry and friends attacked it.

"It" means real Social Security reform: giving Americans the freedom to own and control their own personal retirement accounts. It's purpose is not merely to avoid Social Security's impending bankruptcy, but to radically raise seniors' standard of living, and, in Moynihan's words, eliminate poverty by creating universal, inheritable, intergenerational wealth.

And now, as Kerry's coronation approaches in Boston, Bush's vision is finally advancing in Washington.

Two reform bills have just been introduced in the House, one by Rep. Paul Ryan (R-Wisc.), the other by Sam Johnson (R-TX), with Pat Toomey (PA) and Jeff Flake (AZ) as co-sponsors.

Both bills reco…