Fulfilling Social Security's Promise

Saving Social Security is vital. Other countries have shown the way.

by Rod D. Martin

January 30, 2004

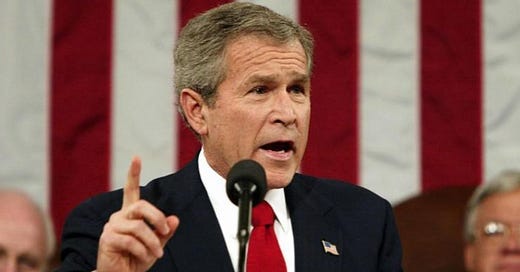

In his State of the Union speech, President Bush courageously stood four-square once again for Social Security reform.

As almost everyone now admits, the system will likely collapse long before the last baby boomer retires. The doomsday clock starts ticking in 2014, when its surplus evaporates.

Politicians speak of a Social Security "trust fund," as though your payroll taxes fill an account with your name on it. But no such animal exists. Were there one, why would there be any debate over whether your money will be there when you retire?

Truth be told, your Social Security taxes support today's recipients. When you retire, tomorrow's workers must support you.

But what if you're a baby boomer? There are too many of you, and not enough of them. And boomers haven't reproduced like their parents. In 1950, there were 13 workers available for every Social Security recipient. Now there are but three.

As former Democratic U.S. Senator Daniel P. Moynihan warned: "Unl…